Here are the pros and cons of doing deals with properties that are currently in pre-foreclosure.

I have people tell me they found a list of properties – all of which are in foreclosure and they feel like they have a gold mine in their hands. Here is the reality of foreclosure lists.

You can watch it in this video.

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

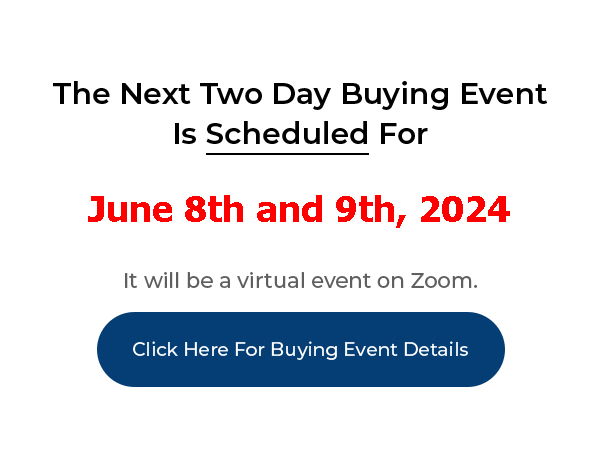

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Read Transcript for “Can This System Work With Homes In Foreclosure?”

“Can your system work in California if you have a home in foreclosure since only a licensed real estate agent can negotiate? If your system can work around this requirement, how is this possible?” – Joseph Maralayo

Joe: If a seller’s property is in foreclosure – if they’ve actually received a notice of default – that means that they’re substantially behind on their payments by at least three or four months, sometimes as much as a year behind on their payments – if that’s the case, it’s going to make it very difficult to do the “For Rent Method” because they have to be brought up to date.

Joe: It might be better just to let it go into foreclosure or to do a short sale which is essentially the same thing to the owner of that property – their credit’s going to be damaged the same way, it’s just going to take longer. And, if they’re doing a short sale it might give them longer in that property without making the payments so there could be some benefits to that.

Joe: Usually, if you just let it go into foreclosure and you don’t do a short sale, you can stay in that property for quite a while before they force you to leave. That doesn’t meant that its comfortable staying in a property that you know you’re eventually going to get kicked out of – there’s a lot of emotional baggage that goes with that, but if you’re just trying to rebuild, sometimes staying in that property is actually a benefit to the banker because you living in that property is better than it being vacant and vandalized and then losing their insurance policy and all of those other things that are going to happen when you’re not there. So a lot of times, it makes sense just to say in that property as the owner and do that.

Joe: You’re not going to be working with those types of deals. The types of deals that we do don’t require attorneys to do it. But if it requires an attorney, then get an attorney. If you feel that it requires an attorney or you come across a situation that requires an attorney, hire an attorney to do it – that’s what they’re for. They cost a few hundred dollars and you’re going to make thousands of dollars on the deal so it’s going to make sense for you to employ somebody good, who understands seller financing, real estate and creative financing – if they understand those things as an attorney, then they’re going to be able to help you.

Joe: If you ask them, ‘Do you understand what taking a property subject to the existing loan means?’ and they don’t understand that, then they’re probably not somebody who you’re going to be able to work with. They don’t have enough experience with creative financing. The term “Subject To” is right on the HUD statement. If you look at a HUD statement, which every real estate attorney looks at every day, there’s a line on there that says, ‘mortgages taken subject to’ which is how we do subject to loans (its different than the For Rent Method).

Joe: But if you have an attorney that understands Subject To, then they’ll understand some of the other creative financing processes that we use, i.e. land contracts, lease options and those types of things. That’s the kind of attorney that you need to find in order to ask and have them work with you. I hope that makes sense. Alright, good luck.