____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

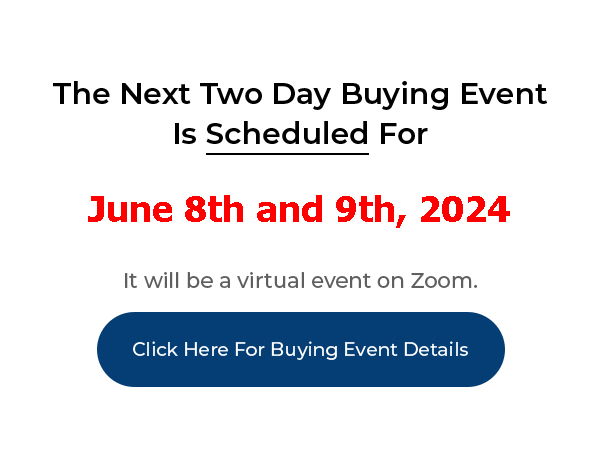

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

How Do I Know When It’s The Right Time To Buy?

Joe: Hey, it’s Joe. I’ve got another question here. This is from Dolly Caswell. Dolly says, “I live in Eagle River, Alaska, just fourteen miles outside of Anchorage. I’m a retired 70-year-old widow and I love real estate.” Congratulations! I love Alaska. What a beautiful, beautiful place. I’ve never been up to Anchorage, though. Juno, though is, I did a river rafting trip on the Tatshenshini that went into the Alsek and down into the ocean off of Glacier Bay. Really beautiful, beautiful place. Best salmon I ever had. Anyway. Enough about my river rafting trips. She says, “I’m debt free. I own a condo in my IRA and my own residence and I have an apartment and several pieces of raw land. The area around Anchorage, including Eagle River and the valley has experienced a rapid rise in real estate values. There are no bargains here. In addition, Alaska’s economy relies heavily on oil for jobs which appear to be evaporating and our state is expecting to cut jobs due to a huge budget deficit.” Yeah, we’re seeing oil drop from $100 a barrel down to $50 down to $30 and who knows where it’s going from there? “Rents are very high so multi-family units sell quickly for a full price and single-family homes are out of my price range. Even fixers get snapped up. I have excellent credit and some cash and pre-qualified for loans but I’m concerned that much as I want to buy, perhaps this is not the right time because of the high risk. My question is am I just a real estate coward or am I using wisdom to wait? And if I wait what on Earth am I waiting for?” All right. Thanks, Dolly.

Joe: First of all, don’t use your cash. Don’t use your credit. Leave all that behind. They say you need money to make money, but my philosophy is if you can’t make money with no money, you sure as Hell can’t make money with money. So don’t spend your credit. It’s too expensive, it’s too high a risk. So, learn how to do this with zero down techniques. After you do zero down techniques there’s no reason ever to really go get a loan. There will be reasons to start using cash at some point, because you’ll have so much cash coming in from the zero down techniques and that’s what a lot of my students do. They’ll start doing the zero down techniques and they’ll start building enough capital to you know, they have all they need to live on so now they want to build their wealth, they want to build their portfolio. So then they take that cash and put it into properties.

Joe: But by the time they get to that point they already understand how, what a good deal is and what makes a good deal and how it become profitable and how to sell it and how to look at the exit strategies and how to look at the zero down structures and which way to structure it the best so that you make the most money doing it. And if you learn those things by doing the zero down structures then it will be a lot easier for you to do these other types of deals.

Joe: Now let’s talk about rapidly-appreciating markets. If you look at San Francisco for example, it’s a crazy market right now and just going nuts. And I’m not familiar with Anchorage so maybe Anchorage is the same. This is the first I’ve heard of it. So I’m guessing that there’s still opportunities there using lease options because we’ve used these all over California. We’ve used them all over you know, the United States. We’ve used them in the UK and Australia and in you know, all over the place. Kazakhstan. I had a guy there. And so these techniques work just about everywhere. In high end markets, in low end markets and rapidly-appreciating markets. In depreciating markets. We used this when the bubble was happening in Florida where it was going up 50% a year and everybody was buying stuff as fast as you could, as fast as they could you know, catch it up. And it still worked. Because we used the for rent method. So that’s what I would first suggest before you write off working in Anchorage. Start using the for rent method.

Joe: And you can learn that, I’ve got a, you know, by going into the Automarketer, there’s training in that that shows you how to use the for rent method and flip properties that way and there’s other training videos on this blog that have that information in it.

Joe: I think you’re absolutely wise not to put your cash in there until you know exactly what you’re doing and you’ve done it before and you’ve made profits. You know, people think, oh, I’ve read a lot of books on this. I should know how to make this. I’ve done all the numbers. They make sense exactly to what this guy told me that I should do. And then they go and they do it and it doesn’t work out that way because they made a mistake here and there, somewhere along the line. If you do that with a zero down deal you’ve lost nothing except your time. Maybe a little bit of your ego, you know. So that’s why you want to do the zero down techniques first.

Joe: Now. Let’s say you get into it and you suddenly decide, you know, this is just too much work. I don’t want to work in this town. Let’s expand and go into a different area. That’s when you’d want to go to you know, pick another town. You know, pick some place in the rust belt, or the Bible belt, or the whatever belt of the United States. Find another market, you know, whether it’s high end or low end. If you’re comfortable talking to people what have $700,000 properties work in more expensive areas. If you’re more comfortable who owns $150,000 property and they are typically less intimidating because they typically have fewer resources and they’re maybe perhaps a little less sophisticated sometimes because of their income level and level of education. Then work in those areas. There’s plenty of them all across the country that you can do all this remotely simply by getting some boots on the ground to put the signs up in the yard for you and doing the work over the phone.

Joe: You can also use the phone system in the Automarketer to get a phone number that’s local to whatever are you want. So if I want to work in, and if I’m in say Texas, and I want to work in Indiana, I can get a 317 Area Code in Indiana phone number so that when people call me back they call that number and when I call them I can call from that number so it shows up on their Caller ID and it makes me look like a local, you know. So these are things that you can use and technology that we have to make your job easier so you don’t have to work locally.

Joe: Anyway, hope that answers the question. Thanks.