____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

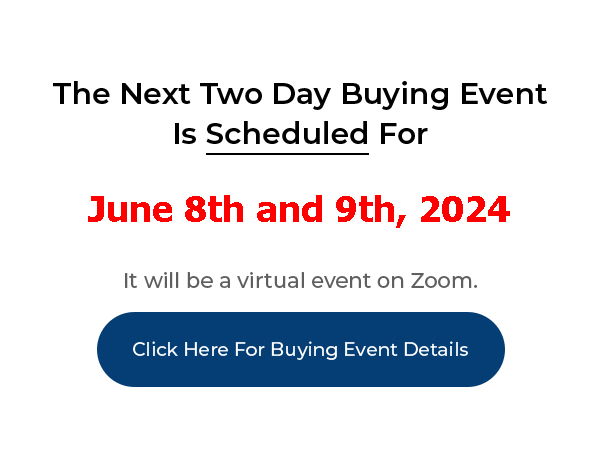

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Sellers Options Part 5: Short Sale – Giving It Back To The Bank

Joe: Hey, it’s Joe Crump. And this is video No. 5 and technique No. 5, or option No. 5. The options that a seller has when they’re trying to get rid of their property. And this option is one that not very many people do these days. It was done a lot back in 2007, 2008, but not very many people are doing it these days. But I think that’s important for you to understand so that if, it makes sense for these particular people because there’s people in different situations, then you can at least offer it to them.

Joe: It also helps them understand that this not a great option but it is an option and that is the short sale. You can give the property back to the bank. Now, when you give a property back to the bank on a short sale, that typically means that they’re not going to come after you as on a recourse basis. That means that if they take the property back you know, foreclose upon it and take it back from you, they’re going to damage your credit and it’s going to show up as a foreclosure on your credit. But they’re not going to come after you for a deficiency judgment. They’re not going to try to, let’s say you owe them $150K, they take it back and they sell it for $100K. They’ve lost $50K.

Joe: In a regular foreclosure, they can come after you for that deficiency in any state that’s a deficiency state. Some states are not. Some states like California are not deficiency states. But Indiana, they could come after you for the deficiency. I rarely see that happen. Because usually the reason people lose their property is because they don’t have any money. So, lenders don’t usually come after them. So, a short sale’s not really that valuable. But they could come after them and do that. So let me read this short, well I guess it’s a little bit longer.

Joe: This is an option that a lot of real estate agents recommend if you’re upside down on your mortgage and need to move. Upside down means that if you subtract your mortgage from the value of you home you won’t have enough money to pay the selling costs of working with an agent. What an agent will do is put the house on the market and try to get current market value for the property. When they find a buyer the agent will then take the offer to the lenders and ask them to discount the price and do a short sale.

Joe: Sometimes the bank sees that short sale makes more sense than going into foreclosure. They discount the property and agree not to sue the current owner for the loss. You’ll not get any money from the closing if they do this. It’s still a foreclosure and it’s not pleasant. It’s just a little bit cleaner than a foreclosure. This is one way to stay in the property and not make the payments while the agent tries to sell the property.

Joe: Unfortunately, when you stop making the payments you’re credit’s ruined and you won’t be able to get another mortgage for at least three years, probably more.

Joe: This is a better deal for the lender and the agent than it is for the borrower. But it does seem to make the borrower fell better about defaulting because they have an agent there who deals with the bank. The damage that is done to the borrower financially and to their credit is the same as a foreclosure, but it feels a bit less painful and there’s something to be said for that. Foreclosures and short sales are a tricky thing and there are a lot of ways that they can play out.

Joe: When you decide to go into foreclosure, you’re deciding to completely trash your credit. It’s a long road to get it back on track and it’ll make a lot of things that you don in life a lot more difficult financially. You’ll need to go to an all cash basis for a while. Plus, there’s the emotional pain of losing your house and being forced to go back on your promise to pay the loan. The lender will do everything they can to make you feel awful about it so don’t let them get to you. You have rights, too.

Joe: But, I’ve seen bankers suggest, privately and not to borrowers, that once a homeowner or borrower decides they can’t make payments any longer, and don’t want or cannot pursue any other avenue, it might be better for the borrower to just stop making their payments and stay in the house until the bank and the court make them move. This can be extremely uncomfortable for the homeowner, but it’s unlikely that anyone but the bank will find out that you’re in foreclosure unless you tell them about it, until you are forced to leave.

Joe: No matter what happens, your neighbors will eventually find out so there’s no avoiding that. But they probably won’t find out that it’s happening when you’re still living there. One way to keep it private is to make sure you continue to respond to the bank when they call you or email you. This will keep them from calling all your relatives and neighbors to try to track you down, which is not a pleasant thing, which they will probably do if they can’t find you or talk to you. They can find your relatives online, most lenders have access to these cross referenced databases and skip trace databases.

Joe: The bank will start the foreclosure process a month or two after you stop paying. Not always, but, nothing happens right away except a few calls trying to collect from you. Then, after three or four months, they’ll file a Notice of Default – NOD. This is a public record, but it usually is only published in the local real estate newspaper. If you continue to talk to the lender, just let them know that you can’t pay and that you’re going to let it go into foreclosure. You don’t need an agent or an attorney to do this. You can do it simply by taking a call from them or sending them a signed letter. Tell them to never call you again and that you understand your rights according to the Fair Credit Collection Act.

Joe: If you ask them to stop, they’re required to stop. If they don’t, you can report them to the Attorney General. Most of the time they will stop calling or mailing you and will continue with the foreclosure action without otherwise harassing you with dun letters and phone calls.

Joe: They must mail you with court dates so you’ll know when all that happens. You’ll also have at least a month or two after the court date notice before you have to be out. Many banks won’t act quickly on a foreclosure. It’s not uncommon for it to take a year or more, but it can happen in three or four months in most areas. At any rate, you can live in the house without making any payments during that time. It’s a little nerve wracking, but if you’re being foreclosed upon, you probably are having some serious financial problems. Having a free place to live for a while might seriously help. So, take advantage of it while it lasts.

Joe: Just remember, they’ll take the house back eventually and you don’t really know exactly when that’s going to happen so have a backup plan in place for when it does happen.

Joe: Your credit can’t start healing until the foreclosure is complete. Most mortgage lenders will not loan to a borrower who has had a foreclosure or a short sale for at least three years after it’s completed. You may be able to get a high interest car loan within a year or two after, if you can show good income by then.

Joe: If foreclosure is the option that you choose, or the option that you’re forced to choose, don’t despair. It’s not the end of the world and it doesn’t mean that you’re bad person. Don’t be intimidated by the collection agencies or the banks. Know your rights and tell them to stop bothering you. Stay in the house as long as you can to conserve your money. You might even want to change your phone number or get a new cellphone. Before you pick this option seriously consider all the other options available out there. Time is of the essence. If you don’t have much equity waiting until you’re late on your payment reduces you options dramatically. So act on it now.

Joe: So, these are, this is the advice that you give to somebody who’s thinking about foreclosure. And sometimes it’s the advice you give to somebody who doesn’t have any equity in the property and they think, I can’t get this property sold, I can’t keep it any longer, you know, I have a hard time, you know, making the payments. I need to move into another property. You know, what can I do?

Joe: And you can tell them, look, you can do this short sale thing. You can let it go into foreclosure. But it’s going to trash your credit. Would you like to buy another property in another place when you do that? If you would, why don’t you do a lease option with me and we’ll do that. Or we’ll do a subject to, or we’ll do a land contract. And you can give them these other options that you can solve their problem. So people don’t have to go into this. Your goal is to try find them before they go late on their payments because it makes it much more difficult.

Joe: If they’re, you know, a couple months behind, you might be able to bring that current for them with your lease option money when you turn around and sell that property on a lease option. But it means you’re not going to have a reserve if you do that. I don’t like to buy properties that are late on their payments. I ask the seller to try to bring them current before I’ll take them over. And then I’ll take them over. And if you lease option them, they’ve got have them current as well.

Joe: A lot of people go after Notice of Default leads because you can buy those types of leads from a lot of different lead companies. And they can be good. But most of them don’t have equity and most of them, or all of them, are behind on their payments because they don’t get a Notice of Default until they’re three months behind on their payments. So, they’re at least three months behind and usually five, ten, two years of behind. You know, if they’re five months behind on their payments and it’s a $1,000 payment, that means they’re $5,000 behind and you’d have to bring that current if you’re going to sell it on a lease option. So, those are things to look out for if you’re trying to deal with Notice of Default leads or pre-foreclosure leads, is what they’re typically called.

Joe: Anyway, I hope this helps. This is another option for a seller is when they’re trying to sell their property.