Here is my next video…

Many people think that because the lender sends the interest deduction form to the seller in a “Subject To” deal, that they are the one who gets that credit.

You can watch it in this video.

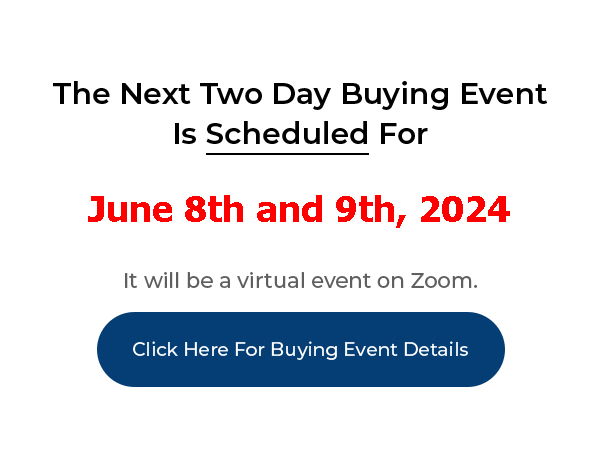

Click Here For Buying Event Details

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Read Transcript for “Who Gets The Tax Credit On “Subject To” Deals, You Or The Seller?“

“You talk about getting a tax credit for paying the mortgage on owner carries and subject to’s. How does that happen? I would think that if the mortgage company has the other owner as the mortgagee, that regardless of who is making the payment – that they would receive the 1098 at the end of the year.” – Derrick Wagner

Joe: The lender isn’t the one that decides who gets the tax credit – it’s the IRS that decides that. And the IRS says that if you make payments on a loan on a property that you own and its interest, then you can deduct that interest from your profit. So it’s all between you and the IRS, not between you and the lender and however the lender reports it doesn’t matter because you have proof of how you paid it. So if I make payments on a Subject To loan over the last year, then I can show them that I made these payments just by if they need to see it, I can show them my cancelled checks or I can show them my bank account and they can see that I made those payments and because the rules in the IRS says that I can take that deduction, then they’ll allow me to do that.

Joe: I also get depreciation on that property if I own it and rent it out so that’s another big benefit. So it’s on the tax basis of the property, I get about 3.6-4% of the tax basis of the property back as a deduction every year because I’m depreciating that property over 27.5 years or at least the tax basis in that property on the improvement not on the land itself. Alright, I hope that helps.