Click Here For Buying Event Details

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

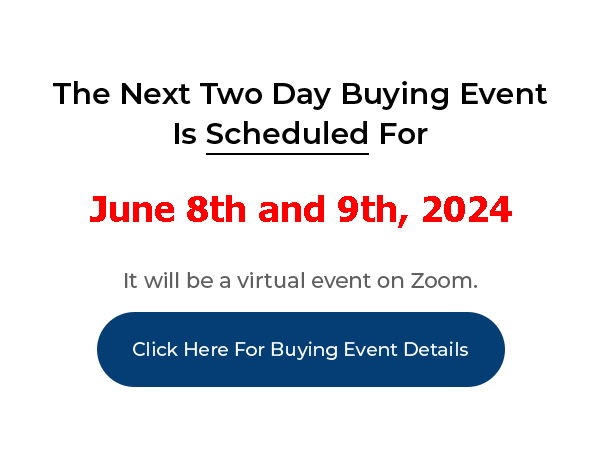

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

How Do I Structure This Deal – $200,000 Equity

Joe: Hey, it’s Joe Crump. I’ve got another hypothetical deal structure of deals that we’re doing with zero down, offers that we’re making with zero down and we’re looking at the buyer has X amount of dollars, or, I’m sorry, has X situation and we’re going to show them how to solve the problem with these zero down structures and make some money doing it.

Joe: This particular property, they’re asking $475K. It’s got an asking price of $675K. It’s got a mortgage on there of $475K so he just wants to get out of the property. He’s got some equity there, but he doesn’t care. He’s just anxious to get out of it. It’s got principal and interest, taxes and insurance comes to $2,900 a month payment on it and it would rent for $3,000 a month. Now. First of all, does it make sense for him to give away $200K? Even though he’s willing to do it, he just wants to get rid of the headache, does it makes sense for him to do that?

Joe: It might. But maybe not. Maybe it makes sense for him to take a lease option tenant in there at $3,000 so he’s got a little bit of cash flow. It’s kind of tight, but it’s pretty much break even or a little bit of cash flow. He does that for a three-year least option at $675K. You raise the price up to $685K. You make $10,000 or $20,000, you raise it enough so you can get $10,000 or $20,000 out of it. So you get the least option fee and you’re going to get him a buyer at $675K.

Joe: Now, that buyer is going to pay him $3,000 a month, so he’s at break even on this property. He’s got a mortgage on there so it’s not costing him anything to keep the property. It’s not costing him anything to sell the property, you know, and he does have the headache of having a possible tenant who might not pay and then he has to go back in and sell it to somebody else after you get rid of that person for him. But you can do that for him. He wouldn’t have to do that for himself, and he would protect that $200K equity position. So that would be one thing that he could do.

Joe: Now, if he doesn’t want to mess with this thing, he might allow you to mess with it. Let’s say, what if I paid you, you know, $500K for the property, or $475K for the property? What I’ll do is make payments to you on either a subject to, because you owe $475K on it, so you just sell it to me subject to. I take over the deed, and I make payments on it. I’m going to make the $2,900 a month payment on it, but I have rents coming in of $3,000. I sold it for, maybe got a $20,000 down payment, so I take that money and I put it in an escrow so in case I have to vacancy or I have to evict this guy I can do that and I can still have money, I have a reserve to cover this cost. I have $200K of equity in this property all of a sudden. And this person stays in there.

Joe: Or, maybe I just take this property and I make the $3,000 a month payments on it, I put it on the MLS and I sell it for $675K and I make, you know, $100K, $150K profit right off the bat. Because this guy didn’t want to mess with it. And that’s something else I can do, too, just make a cash profit. You know, you run into these situations. It’s not that unusual to run into situations like this where you can just take the property, make payments on it for a while while you’re selling it on the MLS. The problem that you might have if you’re inexperienced is not knowing if that $675K is real or not. So you want to find out did they put it on the market with a realtor? If they had a realtor, and the realtor told them it was worth $675 and it’s been on the market for three months and it didn’t sell at $675K, it’s not worth $675K. The MLS will sell a property when you hit it at its market value for very close to market value, usually, on average, 97% of asking price once it sells. But one-third of all the houses that go on the MLS don’t sell and this may have been one of those. If that’s the case, and it’s been on the market for more than a month or two months and it’s not sold, it’s probably not worth what you’re asking for it as long as it’s properly listed on the MLS and you’ve got a proper agent doing it. So, those are things to keep in mind if you’re going to take on a property like this. I think it’d be safer for you to take it on a subject to, find a lease option buyer for it, get $20,000 down, then you close the deal. So you don’t want to make those $3,000, $2,900 a month payments until you have your buyer. That may take you thirty days, you find your buyer, as soon as you find your buyer then you close the subject to. He transfers it to you and you put the $3,000 that he gives you towards the monthly payment. You get your $20,000 that you put in reserve for when you have a vacancy and you know, you hold onto that property and see if they exercise it. And if not, at least you have started paying it off over time. And eventually those values, you know, maybe, you know, come around for you and you’re going to, you’ve already got this big chunk of equity in there so you’re going to be doing well with a property like that. So that would be a nice deal if you had it.

Joe: Anyway. Hope that helps. Thanks.