Click Here For Buying Event Details

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

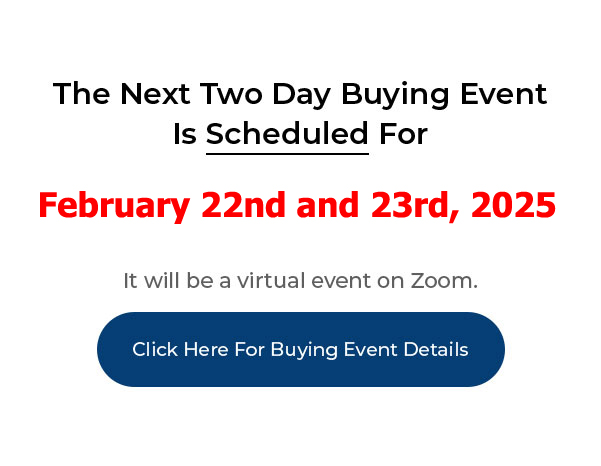

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

How To Make Zero Down Offers – Roleplay Part 1 of 2

How to Make Zero Down Offers. This is a 2-part series and this is may be the most important thing you can learn as a real estate investor and what we’ve done in this classroom, this Zoom classroom with my mentor students is do a role play where one person takes the role of the investor and one person takes the role of the seller. And we have a conversation so that you can get a feel for what it’s like to talk to a seller about buying their properties using these zero down structures. And we pick the specific structure to work with, what I call the For Rent Method, which is essentially flipping a lease option deal so you can get in and get out of a deal quickly, make some cash and move on.

We’ve talked about other zero down structures where you actually keep the properties and build your portfolio and that ultimately is the way you want to go because that’s going to be the thing that makes you wealthy owning the properties. But, sometimes when you’re just getting started you just want to make a little bit of cash. You want to get some money in your pocket, make a few thousand dollars and move on to the next deal. And you can systematize and automate this process so that you can do it less and less, you know, your effort can be less and less over time. All right. I hope you enjoy this class. If you like it, hit the subscribe button, hit the like button. I’d appreciate it. Thanks.

[Joe] So, let’s do another roleplay. This time Daniel is the investor and Bill is the seller –

[Bill] I propose we do something different, Joe.

[Joe] Okay. What do you want –

[Bill] Would one of these people here want to be the seller and I could talk to them so they can tell me what they – so they can feel it, or –

[Daniel] That’s not – because there’s probably some people that are running into the same questions that they could be the seller that keeps giving them all those questions, or whatever – I mean, yeah.

[Bill] Or just give us the question and we could do it. Whichever way. I mean, just to break it up a little.

[Valerie] Okay. I’ll bite. I’ll be the seller.

[Bill] Is that okay, Joe?

[Valerie] That’s up to you, Joe.

[Joe] You know, I think I’d – let’s keep it between Dan and Bill right now. And Valerie if you’ve got a question that you’ve been hearing from your sellers, I think that Bill, you’re going to know the objections more than most people here. So if you be the seller and then you can know the objections. And then Daniel can answer those objections. You’re going to know what these conversations sound like, maybe just because you’ve done a lot more of them.

[Bill] So you want Daniel to buy from me?

[Joe] Daniel is going to buy, you’re going to be the seller.

[Bill] Okay. Good. And, Valerie, did you have something you run into, some questions that he can cover?

[Valerie] No, it’ll – I’m sure you’ll go through them all. If not, I’ll just put – I’ll drop them in the chat.

[Joe] Okay. All right. So –

[Daniel] Ring – ring!

[Bill] Do we get some parameters, Joe? You want some –

[Daniel] Oh, yeah. That’d probably be a good idea. Because otherwise me and Bill would go off the rails like crazy. So, at least give us some bumpers.

[Bill] I will definitely try to stump you in 3.5 seconds.

[Daniel] You will stump me.

[Joe] Daniel’s used to working in a lower-end market, so let’s do a lower-end property. And let’s do a property that’s, you know, let’s just stick it around $125K. Decent condition, For Sale By Owner. They owe $90K. And you can decide what their situation is.

[Bill] Alright, go ahead.

[Daniel] Ring – Ring!

[Bill] Hello.

[Daniel] Uh, yeah. Uh, I was calling about the house that you’ve got for sale on Zillow.

[Bill] Oh, yeah, yeah, yeah.

[Daniel] Yeah, I see here that you’re asking $125K for it.

[Bill] Yeah.

[Daniel] is that correct house? And you’ve just got the one house?

[Bill] Well, I have a house that I live in.

[Daniel] So this is not the house that you live in. This is a different house that you don’t live in.

[Bill] We actually bought this house and lived in it for quite a while. And then we bought a bigger house and we’re in that house now and this house uh – so, hang on. Let’s stop for a second. So, we’re doing rent to own, right, Joe? Yeah – okay. So, this house, I rented it to a relative for quite a while and now –

[Joe] You’re situation doesn’t matter, really.

[Daniel] Am I trying to buy it rent to own – or ?

[Joe] You’re trying to do the for rent deal. The For Rent Method.

[Bill] That’s what I meant. Yeah. Go ahead. So, we lived in this house, I had a relative renting from me, they were just, you know, paying me the mortgage and everything’s been good, but now she’s getting married and they’re getting another house, so I thought I’d just put it on FSBO and see what’s going on out there.

[Daniel] How long had she been living there and renting from you?

[Bill] Oh, maybe six years., five, six year.

[Daniel] It was probably a pretty good deal. You didn’t have to do a lot of you know, landlord headache stuff that normal people do if you don’t have a relative in there, right? Or did she call you all the time when the plumbing stopped up? Was she one of those?

[Bill] No, she was pretty good. I mean, we had a couple issues that we had to fix but I have a guy that cuts their lawn, and, you know, and he does the driveway. She pays me for it, but, you know, he does it. You know, like I said she’s a relative. She’s actually my brother’s daughter, so, I’m trying to help them out. She’s been pretty good. I mean, she’s a good girl.

[Daniel] Was she paying market rent or were you giving her the “family rate”?

[Bill] No, she was paying what I owe. I’m not charging her any more money than what I owe.

[Daniel] And how much is your payment?

[Bill] My payment is, I think it’s $858 a month, I think.

[Daniel] I’m assuming that PITI?

[Bill] What is that?

[Daniel] Uh, principal, interest, taxes and insurance. So all of it?

[Bill] Yeah, yeah.

[Daniel] Alright. Uh –

[Bill] Want to just stop you for a second. Stop the roleplay for a second. Be careful what you say, because people don’t know our language.

[Daniel] Yeah, true.

[Bill] I don’t mean you, Daniel, I just mean –

[Daniel] PITI?

[Bill] I have some PITI for you.

[Daniel] Alright. And I was kind of looking through the pictures a little bit. It looks like, you know, it needs a little bit of work but what – are you aware of any issues with the property? What are some of the main things that are wrong with it?

[Bill] I don’t think there’s too much wrong. Like I said, we had to help her. We had a little bit of trouble with the furnace, but we had it fixed. It’s actually not a furnace, it’s a boiler, because it’s hot water. We had some trouble with, I don’t know, something with the burner or something and it cost me, you know, it was $400 or $500 and I fixed that. And we had a leak on the roof by one of the vents, they said, you know, like, they called it an air vent, was leaking and they fixed that and it’s been fine ever since. But there’s a spot up in the bathroom in the ceiling from when it was leaking. There’s like a stain spot. I didn’t have the ceiling painted but it’s still there. So you’d have to fix that.

[Daniel] Okay. So it sounds like it’s in pretty decent condition. Just some cosmetic stuff. Some paint and normal wear and tear. I get it. Alright. So, have you ever considered selling your property on a lease option for it? It sounds like you’ve had a pretty good run with, you know, your relative renting the place, but how would you like to do this and make a bunch of money doing the same thing?

[Bill] How would that work?

[Daniel] So, I sell all my properties on a three-year lease option. The people – they handle all of their own maintenance and upkeep of the property. We have an agreement with them so that you don’t have the landlord issues. Kind of like what you’re used to with your relative here, except in this situation these people are going to pay you more. So, you’re gong to have some cash flow. Do you have any idea what the potential rent would be if you, you know – what is market rent in the area?

[Bill] I have no idea.

[Daniel] You know, just kind of looking around, it looks like it’s probably going to be about $1,500 a month. Does that sound about right to you?

[Bill] If you say so. Again, I have no idea.

[Daniel] Okay. Well, would you be interested in something like that where you could rent to somebody and, you know, they’re paying $1,500 a month. So you’ve got your $858, you’ve still got all your tax deductions, you don’t have any of the landlord headaches and you’re cash flowing a good, you know, seven hundred bucks a month or so.

[Bill] Yeah, I would consider it, but I don’t want to be a landlord.

[Daniel] Right. Well, that’s, you know, one of the reasons why I sell all of my properties on a lease option like this is because I don’t want to be a landlord either. This eliminates a lot of the landlord headaches, if, you know, if they’re responsible for their own maintenance and upkeep and they have to pay to fix it, they’re a lot less likely to tear something up. You’re not going to get the phone calls in the middle of the night or on Easter Sunday saying that the plumbing’s stopped up or something. They take care of all of that. So, then you’re just cash flowing. Kind of the same situation that you had with your tenant, except better because they’re going to handle the problems plus you’re going to get paid more.

[Bill] So, I’m a little bit confused. So, why wouldn’t I just do this on my own? I don’t know what you’re offering.

[Daniel] Well, so, this is what I do full time. So, there’s a lot of things that you don’t do that you could do, right? You probably go to the doctor and you go to the dentist and you have somebody that cuts your grass and all those things, because they’re professionals. You don’t want to spend your time doing it. They can do it faster, better, cheaper than you can. I can fill the property much quicker. I’ve got a buyers list because I do this all the time. This is what I do 24/7. I’m used to screening people. I can bring you, you know, the cream of the crop. The best people. And then you can look at that and decide who you’d like to have in your property. So, it eliminates some of the risk if I do it, plus it eliminates all the time and headaches that you would have from the learning curve of doing it yourself.

[Bill] Okay, so, I’m confused. Because if I’m going to sell to you for $125K and $1,500 a month, how do you get paid?

[Daniel] So, the buyers pay me an assignment fee whenever I set up and structure the deal. They pay me, then I’m out of the deal. Then the contract is between you and them.

[Bill] How much is that fee?

[Daniel] You know, I try to get as much as I can. The more money that I can get down the less risk it is for you. Because to them, that’s skin in the game. So the more money they can put into something, the less likely it is they’re going to tear it up, the more likely it is that they’re going to exercise their option and buy the property. So, for instance, on this particular property, it’s $125K, you know, I’m probably going to try to get five thousand bucks or something. And I’ll put that on top so you still net the same amount. It’s still $125K to you, but then I’ll sell it to my buyer for $130K and they’ll pay me the $5,000. Does that make sense?

[Bill] Yeah, so what happens if they do damage or they don’t pay?

[Daniel] So, there’s a couple different things. You know, there’s going to be normal wear and tear on any piece of property that you rent. But, you’re making money every month, right? So that pays for that, you get the cash flow, you write off any of those damages. If they really damaged it, your insurance would cover it under vandalism. If they don’t pay, you know, it’s like anything else. If they don’t pay, you’re going to get the house back. You might have to go through an eviction process and get a lawyer. That’s always the worst case scenario. In this situation with a lease option home, they are a lot less likely to do that because they’ve put money down, they’ve got skin in the game, they don’t want to have to walk away from that and go on and do it again. They’re not just a renter. They are trying to repair their credit and buy the house, so, you know, it’s kind of the difference between renting a car and owning a car, or leasing a car. If you rent a car you know that you don’t have to clean it. You don’t wash it, you drive it like and you throw the keys back when you’re done. But if you lease a vehicle you’ve got to change the oil, you’ve got to make all your payments. If you don’t, you’re going to lose it back to the bank, right? Same situation. So, you’re dealing with a different mentality than just a renter that is going to be there and then they’re going to leave.

[Bill] Okay, so, what aren’t you telling me? Because it sounds a little too good to be true.

[Daniel] Uh, well, this is what I do with all my properties. So, I mean, it’d be hard for me to tell you, but I’m not telling you that. It’s hard to say what I don’t know – what you don’t know, right? Just, feel free to ask me any questions. I’ve done this for 24 years or something like that. I’ve done many, many properties. I’ve got my own portfolio of properties. As a matter of fact, the only reason why I’m calling you now is because I have filled all of my properties. Whenever I fill all my properties, then I get on the phone and I call, you know, people like yourself that are trying to sell the property and see if I can put one of my tenants into your property. Because like I said, I keep a huge list. If I don’t have properties to put these people in eventually they’re going to just not call me anymore and be on my list. So, this is what I do for a living, this is what I have to do whenever my properties are filled. So, you kind of get the benefit of all of my work, basically.

[Bill] Okay. Yeah, like I said, it sounds too good to be true. I mean, I’m kind of waiting for the other shoe to drop. So what would we have –

[Daniel] What sounds too good to be true about it?

[Bill] Giving me my asking price, and you’re going to give me more than – I mean, I was getting $858 a month and you’re telling me I can get $1,500. You’re telling me –

[Daniel] Well, yeah… but you were giving her such a good deal, you know, just letting her take over the payments, basically, for you.

[Bill] But you’re also telling me that I don’t have to be a landlord and I don’t have to fix anything. I mean, it just – I mean, it’s not a problem. It’s just, you know what they say. If it sounds too good to be true then it is. And it just feels that way.

[Daniel] Yeah, no, it’s true. And that’s why you should ask as many questions as you want to ask. You can look at my website. There’s a lot of things that I can show you because this is what I do. And it really is that good. You know, I’m always leery of things that are too good to be true as well. There are very few things in life that are. Of course, there’s a down side to this, you know? There’s a down side to everything. Things can go completely wrong. You know, there could be a war. Things could blow up. But that’s not what we do in our daily lives. We don’t look at the absolute worst case scenario. Somewhere in the middle is where things land. You know, if you want to do the math on it, too, it gets even better. So, I’m not sure I want to get into the math with you if you already think this is too good. We haven’t even gotten to the math part yet.

[Bill] Yeah, so why don’t you send me some documents so I can take a look at them and then we can go from there.

[Daniel] Uh, what would you like to look at? What would you like to know? I’ve got a little bit of time here, Bill, I can go through all the stuff with you and –

[Bill] Whatever documents I’m going to need to sign with you to do the deal. Let me see those documents.

[Daniel] Okay. Well, I’ve got – it’s very, very easy. I just have one-page lease option memo that you have to fill out and then – that makes me a principal in the transaction – and I can start marketing your property to my buyers. I can probably bring you a buyer by the end of the week. That’s how many people I have that want a house in your area. Are you in front of a computer right now? I’ll send it to you right now and we can just go over it.

[Bill] What does that mean, make you a principal?

[Daniel] So, I’m not a real estate agent. I’m a real estate investor. You cannot legally sell someone else’s property, you can’t market somebody else’s property. But if you’re a principal in the transaction, then you can basically sell your own property, right? That’s kind of what that is. It give me just the legal right to do that. I don’t have legal ownership, there’s nothing hinky about that. It just gives me the ability to market to other people. Now, like I said, it is a very simple one page agreement. So, you know, if you decide that you don’t like how this is going, if you don’t like the people that I bring you, you can tear it up and just let me know and I’ll pull my marketing. It’s not that big of a deal. And I’ll move on to the next one. Like I said, I’ve got, you know, lots of people that are waiting and I just don’t have the time. I’ve got to find something to put them in. And if it’s not going to be you, it’s going to be somebody else. It might as well be you.

[Bill] Okay, yeah, send over the document. I’ll take a look at it.

[Daniel] Are you in front of the computer right now?

[Bill] No, I’m not.

[Daniel] Alright, well, I can send it over to you. I really don’t have much time the rest of the week, but I do have maybe an hour that I could call you back in maybe two hours or so.

[Bill] Yeah, I’ll be home in about three hours and I could take a look at it.

[Daniel] Okay. So, if I call you back in three hours, we can go over the documents, and then I can show you how you can make that much money, or would you like to talk for just a few more minutes, answer your questions and then I can get somebody in there much faster? Every minute that you delay is just a minute that you’re not getting paid.

[Bill] I’m going to go now. Just send me the document. We’ll talk in a few hours.

[Daniel] Alright. And what’s you email, Bill?

[Bill] I just said too many yeses to get you off the phone at gmail dot com.

[Daniel] Well, I was trying to get five. You know, and it works. Alright, well, I’ll send all that stuff to you and I will call you back in three hours and we can go over everything then. I will also include the numbers, so if you would, take a look at them real quick. You know, they’re worth looking at for just a couple of minutes.

[Bill] Sounds good.

[Daniel] Thanks, Bill.