____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

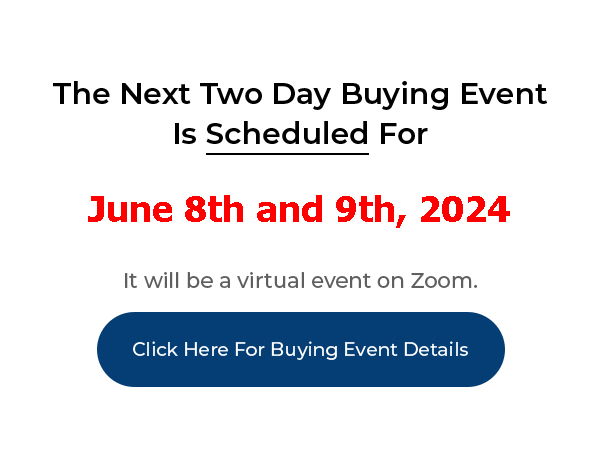

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

What’s The Best Way To Handle Properties With Negative Cash Flow?

Joe: Hey, it’s Joe Crump. Got another question here. This is from Jeff Glass in Nevada. Jeff says, “Prior to the real estate market crash in 2008 I purchased two properties. Property A, former personal residence that’s still under water, $260K value, $265K in debt. I’m currently renting it for $2,000 a month with a mortgage payment of $2,046 principal, interest, taxes and insurance. Property B, investment, $105K value with $118K in debt. I’m currently renting it for $1,000 a month, PITI, is $1,070 a month.” So we’ve got negative on both of those.

Joe: “Both properties are in Chicago and I took a job in Nevada a couple years ago. Do you have any suggestions on the best way to handle these properties owned and over leveraged using the deal hierarchy?”.

Joe: Well, my suggestion is hold onto them. You know, you’ve got very little negative cash flow going here and that’s not bad at all. Also, if you sell these properties on a lease option, you’re going to get a chunk of money. So, both of these properties should make you between $10K and $20K on a lease option fee, maybe half of it in cash and half of it on a promissory note. If you get the promissory note, and this could solve your negative cash flow problem on both of them. Let’s say on this $260K property, it’s $260K value, $265K is how much you owe on it. I’d raise the price up to $285K. I’d raise it by $20K.

Joe: I think you can reasonably go up by 10% on a property when you do a lease option. So you’ve got $20K in equity. Let’s say you only get $10K for the down payment. You get $5,000 in cash and you get another $5,000 on a promissory note that they pay you $200 a month for. That extra $200 a month, that’s going to be your cash flow. And it’s going to take you out of negative and put you in positive. The $5,000 you’re going to put into an escrow so that when this property goes vacant you’re going to have a reserve so that you can make that payment next time. So doing this lease option like this will save you that problem.

Joe: You’re also going to get, remember, depreciation on this property on your taxes. So, you can depreciate the improvement on a property over twenty-seven-and-a-half years. That’s 3.64% of the improvement value on the property. So, on a $260K property, let’s say that $200K of that is the improvement. You could take 3.64% of that, that’s about $7,200 a year and you can deduct that from your taxable income, assuming that your property is active income.

Joe: So if you deduct that from your taxable income and you’re in a 33% tax bracket, that means that you’re going to be making – what is that – about you know, $2,500 a year just on tax savings. That $2,500 a year works out to about $200 a month which is what your negative cash flow is right now. So that alone gets you the money. Plus the income that is coming in and the mortgage that you’re paying down on that, let’s say you’re on the $250K property, you’re paying about $250 or $300 a month in principal. On the $100K property you’re paying about $100, $150 a month in principal depending on how many years you have left on the loan and how much your interest rate is and all that.

Joe: And so that principal will also go down every month, so on each of those properties you’ve got about $300 or $400 a month that’s going towards principal that’s a forced savings account. So there’s another $3,600 a month that you made on that. If these properties go up 3% in the year, you’ve got $250K and $110K property. So you’ve got about $370K. If those go up, that’s, you know, each percent is about $4,000, so it’s about $10,000 or $12,000 they’re going to go up in value every year. So, over a three-year period they go up $30K, that definitely pays your negative cash flow. These properties make sense to keep.

Joe: Chicago’s a good area. There’s no reason to sell these properties and every time it goes vacant, you go out and get another lease option fee, you get more, you know, another note to get more cash flow. There’s some really positive things in this deal. So hold onto these properties, sell them on a lease option, get the lease option fee, raise the, get the down payment higher because you’re going to get a promissory note and cover your negative cash flow and you’re going to do very well with these properties over time because they’re probably going to appreciate and you’re going to be back in the black before long.

Joe: All right, good luck with it.