____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

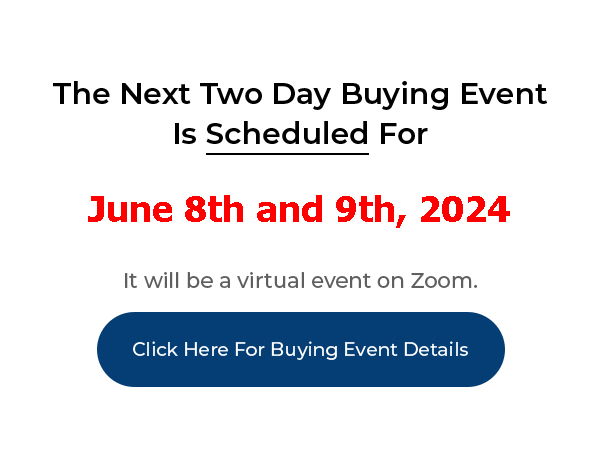

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Where Do I Get The Money To Buy Cash Deals?

Joe: Hey, it’s Joe. Another question here. This is one is from Michelle Lindsey, from Houston, Texas. “I’d like to thank you for the many, many hours you put into this system. What a system. I’m just now getting started, so I’d like to apologize if you’ve already covered this question. Where do you advise us to take the money from if we’re actually buying the house way under value instead of on terms? I’ve heard you say that you have houses inside your IRA. Also, what do you consider way under value?”

Joe: Well, let’s answer that question first. Way under value is anything that’s substantially under market value. If you’re dealing with a property that’s worth $50,000 then $20,000 is way under value if you’re paying $20,000 for it. I’d want to be 50% or more under market value if I’m on a low price property. If I’ve got a $400,000 property, if I’m $100,000 under value, or $150,000 under value, I would consider that substantially under market value. That’s 25%, 30% under market value. So the higher the price the less percentage it can be and still make sense to do it.

Joe: But you want to make sure that it’s very substantially under market value. Remember, there’s only two ways that you make money as a real estate investor. You either buy properties substantially under market value, like I just described, and for cash, or, and you can assign those cash deals to other buyers – I’ll explain that in a minute – or, two, you buy them on terms at or below market value. And that’s a lot of what we’re doing with the other zero down structures, the subject two, multi-mortgage, land contract, assignable cash deals, those types of deals you would buy at market value or below.

Joe: Which means that you can do a lot more properties because there’s a lot more properties that you can buy that are at market value or below than you can buy substantially under market value. Most people don’t want to leave money on the table. A lot of people will. And that’s why wholesaling still makes sense. But you’re going to get one wholesale deal for every one hundred of the other types of zero down structures. So you’re going to have a lot more options if you understand these other tools.

Joe: You know, if all you have is wholesaling, you know, all you’ve got hammer, everything looks like a nail. But if you’ve got these other tools to work with, it opens up and all these other leads that you’ve got suddenly become viable. Leads that you’ve been throwing away every day you could turn into real cash and you could turn into properties that are in your portfolio. So that makes a huge, huge difference.

Joe: And the question about “Where do you advise taking the money from if we’re actually buying the house?” So, if you’re buying the property and you’ve got the cash to do it, if you’ve got it in an IRA, you know, I have a lot of cash in my Roth IRA. And I use that money to buy cash properties. And I continue to build that money in that IRA. But, if the money is in a regular business account, you can also use that money and you can, you’ll have to pay taxes on that money, but you can also use that money before you become 59 ½ years old and you could actually live on that money if you choose to as you’re flipping properties to do it.

Joe: My suggestion though is, if you have cash to invest that you put it someplace that is completely safe. The reason I buy in my Roth with all cash is because you can’t use loans that have any recourse to them. So if I use a lender I have to use non-recourse loans, which I could do a subject to and those types of things, but then you’ve got UBIT taxes, you have to pay, yeah, you don’t get the benefit of the income that you’ve borrowed inside a Roth, so I would rather just use my cash inside a Roth and leave that money there and not ever touch it again until I retire and let that money come out at me tax free afterwards. So that’s the beauty of those Roth IRA’s.

Joe: Now, if you have other cash, you could put it into a business account. I would also keep that money and try to buy properties for as close to all cash as possible and then you know, get the income on it. All the other types of deals, where you’re using loans, use other peoples’ loans. Don’t ever use your own loans. Don’t use your own name, or your own credit on these deals. You don’t have to qualify, you don’t need good credit, you don’t need down payments. You don’t have any risk and that’s when you can use loans. Because if things fall apart, if the market goes crazy, if you have too many vacancies, you can’t afford to make the payments, you can just give them back to the seller and you haven’t lost anything.

Joe: You can’t do that with a bank. If you give it back to a bank, it’s going to screw up your credit, you’re going to lose all the capital that you put down on a down payment, so do it the way that I’m teaching. It’ll save you a lot of headaches.

Joe: All right. I hope that explains it. There’s a lot of different ways to use your own capital, but make sure that when you’re using your own capital that you keep it safe. Don’t spend your own capital. Don’t you spend your own credit to buy properties. The biggest mistakes I’ve made in my career is when I’ve done those things. The only time that it’s been safe, or the most safe, for me to use my own capital, is to buy properties for cash. And that’s what I would suggest you do. Even if you’re in a high end market, buy properties and you only have $50,000, go into a market where you can buy $50,000 properties or $20,000 properties and make sure you get good management and take care of those properties. And you can flip that money into bigger and bigger and bigger properties. But make sure that you don’t lose the money that you made. It’s too hard to make in the first place.

Joe: All right. I hope that helps.