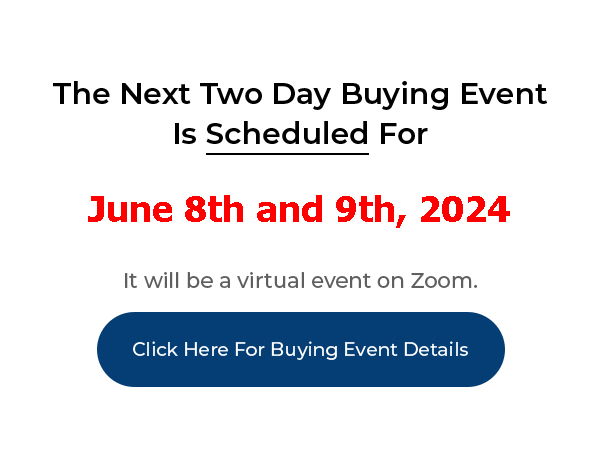

Click Here For Buying Event Details

I’m on a rant today.

I wrote a book on credit repair. I think it’s nice to have good credit.

But getting good credit isn’t a way to be rich. You are NOT your credit report – don’t let anyone tell you that you are.

Sam Walton said that he didn’t trust anyone who hasn’t gone bankrupt at least 3 times.

That seems a bit extreme, but I see his point.

It also makes you wonder who kept giving him money to build new businesses every time he lost everything. (here’s a secret – he didn’t raise money using his credit)

Good credit is meaningless. In fact, it’s worse than meaningless. It’s a way to keep you under control.

I’m no conspiracy theorist – I’m talking about the chains that bind you – but I think that the key to those chains is in our pocket. We know it’s there, we just don’t think we should reach for it. It just wouldn’t be the right thing to do.

You’ve probably heard stories about the “Company Store.” The coal mining companies of days past made their workers buy everything they needed from the company store. And they had complete control over what the workers bought and how much they paid.

They were even so good as to give you credit till next payday. That way you could take milk home to the baby and put some food on the table. They were generous with their loans. And those loans just kept getting higher and higher because you couldn’t support yourself on the wage they gave you.

The old miner songs say – “I owe my soul to the company store.”

That is what debt does – it steals your freedom. It makes you nervous and it makes you afraid – and it keeps your nose to the grindstone – or it makes you give up in despair.

In Europe, in the old days, they had debtor’s prison. Ever heard of the Bastille?

In the USA, we have bankruptcy laws that protect borrowers. They can’t put you in jail for not paying your debts anymore.

So they came up with something else. They came up with credit scores.

Credit scores are their own kind of chains. If you fear to drop below that magical 700 FICO and you do everything you can to keep that from happening, maybe something else is working on your head than just honor.

We believe – and rightfully so – that we should honor our debts. That we should make good on our promises. I agree. There are people who owe me money and I hope they keep paying.

If we build an entire society and commerce system on debt, we must all fulfill our roles – right? The borrowers and the lenders.

When 2008 came around, everyone believed that the system was broken. We thought that maybe the system was heading toward collapse because nobody could pay their mortgages any longer – the bubble had popped at last.

The “consumer” (that’s you) – lost confidence, got really scared and quit buying. The lenders, (that’s the bank) stopped lending. They were afraid too – they had made billions of dollars of loans they knew were bad loans to people who couldn’t afford to pay them and then sold those loans as “A” paper. I believe they put the brakes on lending to keep a low profile and hope to god they didn’t get thrown in jail.

The loan freeze created a daisy chain of businesses going under.

The businesses started laying off workers – midlevel management people took the biggest hit. The middle class lost their jobs.

After a while, big business started making money and hiring again. But this time, they hired fewer people at lower wages.

The income gap between rich and poor widened.

I’m no economist. I just watch what is going on to the people around me. I watch what I’m thinking and how important some things are to me – especially when I know intellectually that they may not be as important as I fear they are.

I have good credit – perfect credit really – but I’m willing to trash that credit in a second if I think it is the best way to protect my family.

I had to trash it once before in 1991 and I waited till the very last minute before I did. I won’t wait so long next time – if that time ever comes.

When my business crashed for me more than 20 years ago (1991), my credit took the hit. I didn’t protect my family and myself the way I should have. I tried to pay back everyone I owed money. It just seemed like the right thing to do.

That was a mistake. Instead, protect the ones you love. Stay alive and try again tomorrow.

It’s not over till you’re dead.

So what is my point?

Stop thinking you need good credit to become rich. Stop thinking the almighty FICO score will determine if you are a “quality” person or a “bad risk.”

Bypass credit – bypass banks – bypass allowing someone else to decide if you QUALIFY for their beneficent loan.

Quit begging. Quit asking someone else to give you something, approve “you” for something, see how valuable what you have to offer is and buy it.

Start controlling your roll in the world. Start deciding who you want to be and then become that person.

Stop doing what you hate and start doing what you love.

I’m not saying that you should hurt others or be irresponsible or not fulfill your promises. I AM saying that you should follow your dreams. I AM saying that you should QUALIFY yourself – that you should APPROVE yourself – hell, don’t just approve yourself, PRE-APPROVE yourself.

You don’t need permission from anyone but yourself.

And I’m not just talking to folks with bad credit, this is just as important – perhaps more so – to those of you who have good credit. If you have good credit, it’s easy to be lulled into using that credit because you THINK it’s easier make money that way – but it’s not easier to MAKE money if you have good credit, it’s just easier to SPEND money – and it’s much, much riskier.

You don’t need money to make money. This is a myth. If you can’t make money with NO money, you sure can’t make money WITH money.

Unchain yourself from credit.

The keys are in your pocket – dig in – release your chains and start thinking about this in a very different way.

Julius Caesar had a son who was a commander in the Roman Army. Things were not going well for him on the battlefield. His men were getting decimated and defeat loomed large.

Caesar wrote a letter to his son (and I paraphrase) – he said. “When you find yourself in an unthinkable position, change the way you think about it.”

Change the way you think about building your own business. Change the way you think about your own success. Change the way you think about what you NEED in order to succeed.

Then, look for unconventional ways to move forward – honorable ways, ethical ways – ways that are guided by love and compassion without being bound to what your old ways of thinking want you to believe.

Nobody is at fault but you.

Nobody can unchain you but you.

Nobody will do it for you.

Peace,

Joe

Six Month Mentor Program: http://www.ZeroDownInvesting.com

Automation Software For Investors: http://www.PushButtonAutomarketer.com

My new book, Automated Real Estate Investing: Click Here