Click Here For Buying Event Details

____________________________________________________________

This video shows you how to make passive income with real estate investing by following a proven system. Unlock the secret to generating wealth and grow your property investment business in ways you never thought possible!

My PushButton Automarketer Program – Automate your business:

http://sales.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

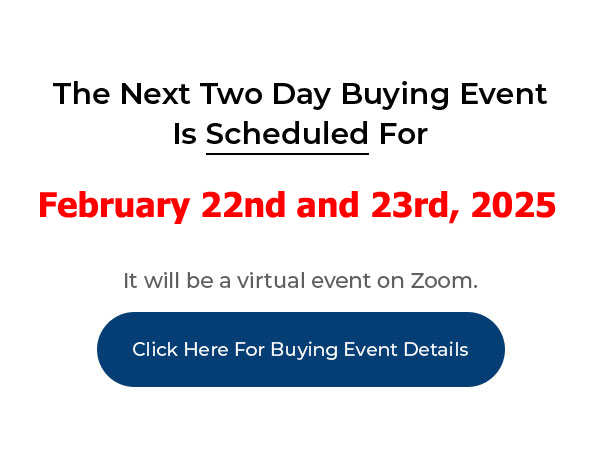

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

How Do I Make Passive Income With Real Estate Investing?

Joe: Hey, it’s Joe Crump. This question is, “Joe, how do I make passive income with real estate investing?” Passive income is the best type of income. You don’t have to do anything and money comes in. It’s based upon an asset that you have rather than a task that you do. And having a good portfolio is the best way to make that happen.

Joe: Now, with my portfolio I have to do very little. I still have to do a few things. I have to look at my reports that come in from my bookkeeper once a month. Every once in a while I get an email from my property manager asking me about a rehab or something that they’re working on, do you want to replace this furnace or do you want to do this, or do you want to do that? Sometimes I’ll get those types of questions. But, I’ve been working with these people long enough where they know what to do. And they know where to spend the money and where not to spend the money and I just count on them to do that.

Joe: At the beginning it was a little bit more time consuming, but it became less and less over the years. And now it’s gotten to the point where I get my reports once a month. I look at those reports, I make sure everything is paid. My bookkeeper makes all the payments for me to any mortgages we might have. Make sure everything is balance on our checkbook. Make sure the money goes into the right LLCs to cover these properties. You know, we just have to make sure that when we bought the property that we structured it properly. And that leaves me time to go out and find more properties or find other partners who help me find more properties. Even that is a passive process for me. I don’t have to do very much.

Joe: Although when we do buy properties, I have to sign the documents. I’ll go down to the bank or something and sign in front of a notary. Because most of the properties that we’re buying I buy remotely. So I don’t even have to go to a title company to do that work. I have them send me the documents either by mail, or usually in a .pdf file. I print it out and then I do the live signatures in front of them, and then we send out those documents to them.

Joe: So, once we’ve done that, and once we have those properties, that money is going to be income that comes in basically for the rest of my life, or until I get rid of that property. And all I have to do is kind of pay attention to make sure that it’s still making money. And what I’ll do is, we’ve created a spreadsheet, or I had my bookkeeper create a spreadsheet and I said here’s what I want to see on this spreadsheet. And I have her update it once every quarter so we can go in and see where we’re at. But what it does is, it has a page for each property and it has a column for each month and I can see the expenses and income for each month.

Joe: At the bottom of that column I can see was that positive or negative and how much was it positive or negative. And then we’ll see at the end of the year what those twelve months are and we’ll see what the positive negative was at the end of the year on that particular property. Do I have positive cash flow? Is it still in good shape? You know, what were my expenses? Where did I have vacancies? Which months show no income? Which months show big expense because we replaced a furnace? All those things are right there on that spreadsheet.

Joe: Also on that spreadsheet I’ll have an overview map so I can look at how long I’ve owned that property, what I originally paid for that property, how much I originally put into the rehab on that property, if any, and what the current value is on that property. So, I break apart the initial cost to buy the property which is the purchase price and the rehab. I put that into one section, and then I put the other expenses, the ongoing expenses into another section. And then we can see the amount of money that we’ve made over the period of time that we’ve made and we can figure the percentage of a return on investment that we have on the money that I’ve invested in that property.

Joe: We can also look at what the equity is on that property and see where that’s at. That way it will give me a pretty good idea as I scroll through my portfolio which properties are performing the best, which ones are performing the worst. Should I maybe get rid of a property because it’s going into negative cash flow that I don’t like? Negative cash flow can eat you alive, so you want to make sure you’re always paying attention to your negative cash flow and getting rid of that stuff when that’s necessary.

Joe: But that’s usually not a big problem. You just wait until the tenant moves out, get the property cleaned up. I put the properties on the MLS. I don’t even list them myself anymore. I have a real estate license, I’m a member of the board, I’m a broker, I still usually use my property manager to sell those properties and I pay them a full commission to do that. I don’t need to do that, but I want to do that because I don’t really want to deal with it myself. I want this money to be as passive as I can so I can focus on things that will make me more money than what I can do with that. Or, just let me have my life. Let me have control of my life and be able to do the things that I want to do. I don’t necessarily have to make money on everything I do if it’s something that I enjoy.

Joe: So, those are the things that you want to do as you start building this portfolio. And you want to start thinking about where can I get passive income. You also want to think a little bit about active income. Active income that doesn’t take a lot of time. If you want to build an active income business that maybe takes you eight to ten hours a week, you can build a business that will bring you in $75,000, $100,000, $150,000 a year just by doing the For Rent Method. I’ve seen so many of my students succeed on that level.

Joe: And then as they do that they start realizing, hey, there’s other properties I can buy to build my portfolio and the portfolio is what actually makes them rich. But, having the active income from putting in a few hours a week putting deals together can make them, well, it can give them back their freedom because they can quit their full time job once they get a stable income created. And they don’t have to worry about it ever again because these techniques have been evergreen. We’ve been using these techniques for 25, 30 years. And they’ve been working in low end markets, high end markets, appreciating markets, depreciating markets. They’ve worked in every market. They’ve worked in markets in the country and Canada and UK and Europe and I had a guy in Kazakhstan. I had a guy in Perth, Australia. We’ve had people all over the world. I had a guy in Dubai. We’ve had people all over the place do these types of deals.

Joe: And some people would work, I had a guy in Australia that was working in the country as well, in the United States, as well. So, he was doing deals from Sydney in California. So, you can do this in a lot of different ways and you can set these businesses up so they don’t take a lot of your time and you’ll have your freedom and for me, freedom is much better than money.

Joe: If I have control of my life, control of my time, I have enough money to live on in a way that I feel comfortable, then I don’t need to be a billionaire. And what you find is, if you start enjoying the work, which a lot of my students do, and I think that that’s going to make it a lot easier for you, if you enjoy this process. But as you start enjoying this work, and as you get better at it, and you see the money coming in, it’s like, oh, yeah, that’s kind of fun.

Joe: So, you do that work, you see your bank account grow and it grows much faster because you’re putting more energy into it and it’s happening.

Joe: But even if you don’t have that time to put into it, or don’t want to put that time into it, I have a couple of people who are like, missionaries, or pastors. I have people who are artists. I have people that like to travel. I have a guy who’s an environmentalist who travels around doing ocean work but he also does real estate on the side. He’s still making over six figures a year putting in very few hours a week and is able to travel anywhere he wants. Now, kind of have to wait until you can start flying again, but those things are possible.

Joe: Anyway. That’s how you build a passive investment portfolio. Find properties, and find properties that are going to pay for themselves and give you positive cash flow. Be very careful about borrowing money from a bank. I really strongly recommend that you learn how to do it with no money and no credit first before you ever go to the banks and then once you’ve done that you probably won’t want to go to the banks because it’s just not necessary. There’s better, safer ways to do it and don’t put the rest of your portfolio at risk.

Joe: All right. If you like this channel, hit subscribe. Go to JoeCrumpBlog.com and sign up for my free newsletter. PushButtonAutomarketer.com is my automation system and ZeroDownInvesting.com is my mentor program, my six month mentor program where I work with you personally to build your own business and walk you through the process, kind of take you by the hand and help you walk through the mine field and turn it into success.

Joe: All right – Good luck to you.