Click Here For Buying Event Details

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

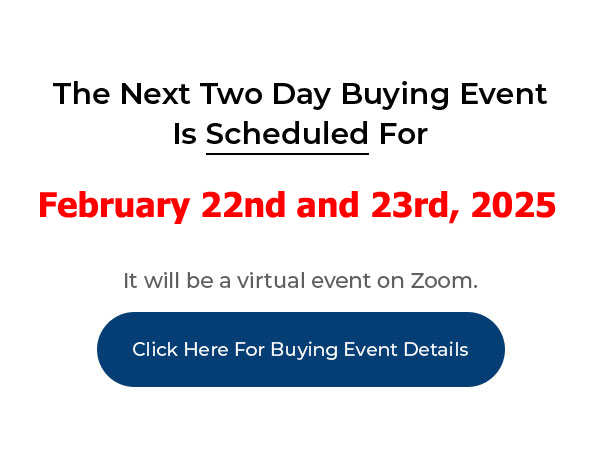

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Hypothetical Zero Down Deals – Part 6 of 6

Hypothetical Zero Down Structures. This is part 6 of a 6-part series. My name is Joe Crump and this was done in front of a class of my mentor Jerrys. I hope you enjoy it. It will really help you understand different ways that you can purchase property without using any of your cash. There’s a lot of ways to do this that can make you a lot of money. All right. I hope you enjoy it. If you do, click the subscribe button, hit the like button. I appreciate it.

[Joe] All right. So, $95K the asking price. The value is $110K. It’s condition is dated but, you know, it’s habitable. It’s got orange carpet or, you know, it’s maybe ugly, but maybe it smells a little like a dog. But everything works. Doors shut, electricity works, furnace works. It’s got no mortgage on it. They own it free and clear. And it’s got potential rental income of $1,100 a month as it stands. Even in the condition that it’s in.

So, will this work as a subject to?

[Jerry] No.

[Joe] Because ?

[Jerry] It’s no mortgage.

[Joe] Okay. Will it work as a multi-mortgage?

[Jerrys] Yes.

[Joe] Okay. So how would that work?

[Jerry] This would be little tougher than the other one, right, because the asking price was so high?

[Joe] Well –

[Valerie] The value’s $110K. Asking price is $95K. So…

[Jerry] You would have to negotiate that down a little bit, wouldn’t you?

[Joe] Well, let’s say he’s not going to negotiate it. Can you still make it work?

[Valerie] The value is higher than what he’s asking for? So, aren’t you going to lose?

[Joe] No, he’s asking $95K, but it’s worth $100K.

[Valerie] So you would make –

[Joe] There’s $15K of equity there.

[Jerry] You could make it work, but your exit strategy would kind of have to be like, flipping it – I think.

[Umberto] Maybe you can wholesale it, right, you can wholesale it. You can, you do $95K, you resell it $110K. It’s ready to go, an investor will buy it.

[Joe] No investor’s going to go for $15K. It’ll cost that much to sell it let alone fix it up. So there’s not enough to make that work. I mean, ideally you negotiate down. Jerry was right about that. But let’s say this guy is not going to negotiate, and he is willing to do terms.

[Valerie] Why not just do a lease option?

[Joe] Let’s say that, you know, we’re on multi-mortgage right now. Let’s say he’s willing to do a multi-mortgage. How would you structure a multi-mortgage on this?

[Valerie] I’m still confused on what a multi-mortgage is.

[Joe] Okay. So, a multi-mortgage is very much like a subject to. Except it can either have a mortgage or not a mortgage. So, it may not be the best name for it because you can do it without a mortgage. So, if you have a multi-mortgage and it doesn’t have a mortgage on it, the property doesn’t have a mortgage on it. And you transfer the deed. The seller transfers the deed to you and puts a new mortgage on the property where you’re the borrower and he’s the lender. That’s what we’re talking about here.

[Valerie] It doesn’t show anything of what they owe. They don’t owe anything, so…?

[Joe] They don’t owe anything. So every payment you make goes to them. Every payment you make goes to them. So how do you structure that deal? What kind of offer do you make to that seller on that – if he definitely wants the $95K, how can you make this profitable for yourself?

[Valerie] Well, you have to consider taxes, insurance and cash flow.

[Joe] Okay.

[Jerry] One of the things you could do after you run your numbers is get him to finance at least part of that huge asking price, maybe –

[Joe] Let’s not go there yet. So, Valerie, you said taxes, insurance – right?

[Valerie] That’s true.

[Joe] Okay, so how do you figure out what you can pay him monthly?

[Valerie] The PITI is zero.

[Joe] No, well, that’s what it is now, but the rental income is $1,100 a month. That’s the potential rental income. So if we know that we have potential rental income of $1,100 a month on our exit, how much can we pay on that $95K?

[Valerie] We back it out. We do $95K divided by 1,100.

[Joe] Well, that doesn’t quite work because you’ve got taxes and insurance.

[Valerie] Yeah, that’s what I said.

[Joe] Okay, so, $1,100, let’s say taxes are $100 and insurance is $50.

[Valerie] 1,250 minus –

[Joe] Well, no, it’s 1,100 is the income.

[Esther] It’s $950.

[Joe] Right. So, $950 is what’s left after taxes and insurance. But you also need cash flow.

[Esther] So you would say what, $300?

[Joe] How much cash flow have we been talking about? $200, right?

[Esther] Yeah.

[Joe] Let’s say $200. So, 950 – 200 –

[Esther] 750.

[Joe] 750. So, that 750 would be enough to give you $200 a month positive cash flow, pay your taxes and insurance and still make payments to him of $750 on that $95K. See how we came up with that?

[Esther] Yeah. Yes.

[Joe] We take that $95K, we divide it into – by 750 – and that’s 126 months.

[Esther] Ouch!

[Joe] Divide that by 12, that’s 10 years, 10.5 years. So we’re going to do a mortgage of 10.5 years at $750 a month on this property to this seller. This is an amazing deal for you. Amazing deal. Even though he’s only got $15K of equity, the reason it’s amazing is because…..?

[Umberto] Because all payments are going to equity –

[Joe] Principal. Exactly. $750 a month goes toward paying this thing down. So every dollar that you’re giving him is equity, is money that you’re making as income. Plus the other $200 on top of that that you’re getting.

[Esther] So you said that for multi-mortgage you’re going to put – I don’t know what you said – which – where you said as a balloon. Every this one you’re going to put a balloon in.

[Valerie] That’s land contract.

[Joe] When you’re buying you’re not. You’re going to sell this property now. But when you sell it, you’re probably going to sell it on a lease with an option to buy. Because that gives your buyer less control. You want your buyers to have less control. So lease option, that gives them less control and you don’t want them buying down that note. If you do it in a land contract they’re buying down their note every month. They’re paying toward principal. You don’t want that. Lease option, they’re just paying rent.

[Valerie] Yeah, that’s true. And you keep that $200 coming in cash flow plus somebody else is bearing the brunt of the monthly payments – you’re good. You don’t want them to exercise their option to buy – right?

[Joe] Ideally, no. Yeah. There’s only a 30% chance that they will, and the value will go up over time. So if they don’t buy you win. If they do buy, you cash out and you make a chunk of money. Because if they do it over a three-year period, they’re going to be buying down that note substantially, $750 over you know, 36 months, that’s – what is that? Almost $30K.

[Valerie] Wow.

[Joe] In three years. Plus, you’ve got the other $15K they’re going to have to pay you, plus you’re going to raise the price because you’re selling on a lease option. You’re going to sell it on a lease option for $120K because the value’s $110K. And you’re going to ask for $10K down payment. So you’re going to get $5,000 of that up front, right in your pocket. And then you’re getting the other $5,000 with $200 a month. So instead of paying you $200 a month positive cash flow you’re getting $400 a month positive cash flow in addition to that $750. So that’s an extra $5,000 – that cash flow is $5,000 a year. So that’s an extra $15K there. So, you know, this property is doing really well for you depending on when you actually have to cash out of it.

[Valerie] Yeah

[Esther] Question. So, if you were, say for example you were selling this on a land contract and what if they stopped paying? Then would you have to go through the foreclosure process like you do with a regular mortgage?

[Joe] Possibly. Most of the time when people default on land contracts, if you didn’t record it, you know, if you didn’t record the land contract, it’s easy for you to just agree with them to move out. They move out, say, look, you move out, I won’t sue you for the balance which you owe me and we’ll be okay. And I’ll just sell it to somebody else. And then you tear up that land contract. If they recorded it, then it’s harder because you have to get it off the title. So you have to get them to sign something. And they might sign something, you know, in order not to be sued for the balance. So they might do that, or, and if you have to go through – it’s a judicial proceeding, it’s not a foreclosure.

But it is a judicial proceeding that has to go through a superior court. And that typically takes anywhere from a month to four months to get rid of them.

[Valerie] So should you record it or not record it?

[Joe] If you’re selling, you don’t record. If you’re buying on a land contract you definitely record it. You want to make it as hard as possible to get rid of you.

[Esther] So if you’re selling you’re just going to hold it?

[Joe] If you’re selling it – but – yeah, I mean, unless they demand or ask you to record it, you’re going to hold on to the original. And then, you know, you’re not going to cheat them, you’re just going to – if they stop paying you’re going to ask them to move out. And if they don’t, then you’ll have to go through a judicial process. But you won’t have to deal with cleaning up the title.

[Valerie] I have a question. If you’re a landlord and say for example your tenants ask you for like, a receipt for monthly rental payments and the landlord never gives the receipt, what kind of recourse is there?

[Joe] Well, you’ve got cancelled checks. If you’re giving them cash that’s a problem. You don’t have much recourse if you give cash and don’t get a receipt.

[Valerie] So, you’re making transfers. Online.

[Joe] That can be documented. Online transfers can be documented. So, that can be a really sweet deal. Even though there’s not that much equity in the property, even though it’s not in great condition, it’s got great income. So it’s got a lot of potential here. So, you could buy this thing with a multi-mortgage. You could buy it with a land contract – right? If you bought it with a land contract, how would you do that?

[Esther] You would get the deed and then you would make –

[Joe] Remember – no deed. No deed on a land contract.

[Esther] Oh, I thought it was contract to deed?

[Joe] Well, the contract is what you’re getting. And the deed you only get after it’s paid off.

[Esther] Oh, I thought it was – okay – it’s called contract for deed.

[Joe] Mm-hmm. You’re doing a contract in order to get the deed.

[Esther] Okay. Contract for deed. Contract for deed. Okay.

[Joe] So, let’s say if you’re buying this on a land contract you can structure the deal exactly the same way as –

[Valerie] You make it fully amortized, no recourse, zero interest, record the land contract.

[Joe] Exactly. Exactly. And if you can’t sell it on a land contract, because you bought it on a land contract, which I think is the case, then how would you get rid of it? How would you sell the property? What are your options?

[Valerie] Non-recordable. Charge interest –

[Joe] Let’s say you can’t sell it on a land contract. So the way you look at this is is there’s – you can use this structure to kind of figure out how you can sell, because if you’re buying it on a land contract you can sell it on a lease option, you can sell it for cash. If you buy it subject to, theoretically you could sell it multi-mortgage, sell it land contract, sell it lease option, sell it assignable cash deal. If you buy it multi-mortgage you can sell it land contract or lease option, cash deal.

[Valerie] Oh, you have to go down. You can’t up.

[Joe] Always going – yeah – so, what that does, by being at the top of the hierarchy it gives you more options on your exit strategy. So what you’re trying to do is to have as many options as possible. That’s why we like multi-mortgage in the deed better than land contract.

[Valerie] Okay, because you’re still struggling to get the deed at land contract.

[Joe] Yeah, you’re still – you’re not – you don’t have the deed yet. You have more control. You have enough control. Whereas with lease option you don’t have the control. So if you bought it on land contract you’re going to sell it probably on a lease option, or you’re going to sell it for cash. Not assignable cash, but probably cash. It’s also possible that you assign your right to buy it on a land contract. But you’d have to make that land contract assignable when you bought it. Which most of them are not unless you ask for it.

[Jerry] Could you buy and hold?

[Joe] Yeah, that’s kind of what you’re doing. You’re buying on a land contract, holding onto it and selling it on a lease option. Or, you can rent it. You could rent the property. There’s always that.

[Jerry] Oh, I see that now. For some reason I didn’t equate there. So, yeah, the option is there.

[Joe] And, can you buy this on a lease option?

[Valerie] Yeah, with this land contract you can.

[Joe] Yeah. I mean, I’m talking about if you – from the seller – could you buy this on a lease option?

[Jerry] You could.

[Valerie] I wonder, something you’re spending to bring it up to snuff. It says condition dated but good.

[Joe] So, this is what I was talking about earlier on lease options. Buying on a lease option. I believe it’s unwise. Don’t buy on a lease option. You sell on a lease option. Because you don’t have the control. If they decide not to close the deal it’s really hard to force that sale. And what a lot of people are teaching is this sandwich lease option where you’re buying it on a lease option and then turning around and selling it on a lease option. Because you can do that. That’s called a sandwich lease. But it just doesn’t give you enough control, whereas a land contract does give you enough control. Plus, a land contract, you can set it up so it’s zero interest and fully amortized and it doesn’t have a balloon on it because most sandwich lease options have balloons on them.

And that’s what Bill was talking about yesterday when he said, you know, you buy these properties, you know, with three years or five years balloons and then he would have to, you know, then he’d have three of them that were coming due in one year and he’d have to figure out a way to pay those things off. And that would always create a lot of stress. You don’t want to create stress for yourself in the future. You want to structure your deals properly so you don’t have the stress in the future.

Are these hypothetical deals valuable? I mean, are you –

[Jerry] Very, very – thank you.

[Esther] Yeah, they are. Can we do some of these on our mentor calls?

[Joe] You bet. Bill had suggested that, too, and I think it’s pretty worthwhile because it forces you to think through not just the purchase, but the sale. And it looks at all the other options so that you can say what’s going to be optimal for me as an investor? And then you can look at the seller and say what makes sense for them? You know, is this going to make sense for them? And I think that everything that we’ve, you know, everything that we’ve suggested for these sellers, it does make sense in most situations. So I don’t think it’s a big stretch for that.