____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

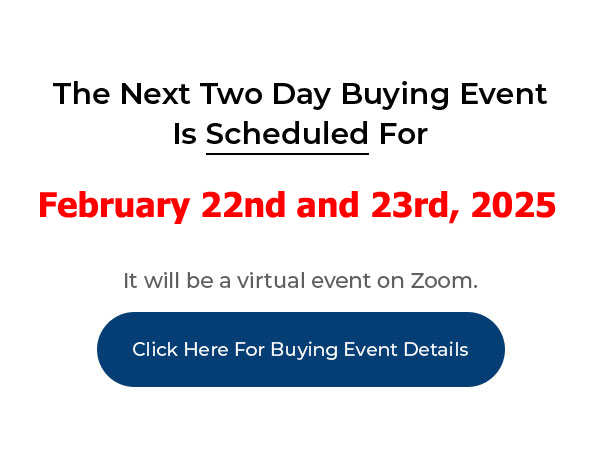

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Read Transcript for “The Seller Told Me Their Lender Forbids Rent To Own“

“What do you say when the seller says their mortgage contract forbids rent to own or the bank requires that the owner occupies the home?” – Denise McKune

Joe: There’s different kinds of loans that you can go out there and get. One is owner occupied loans. One is for investors. An owner occupied loan – the stipulation is that your intention when you move into it is to occupy that property. That doesn’t mean that you have to live there for 30 years. What it means is that your intention when you bought it was to move into it. Now, you should actually move into that property – don’t say it’s my intention and then not move into it. But if you’ve had that property, and these people presumably have already been living there so they’ve been occupying that property – the lenders will allow them to do it, and there’s nothing in their loan documents that will say that they can’t rent that property. So have them look at their loan documents and I think you’ll be able to prove that to them through that process.

Joe: Now another thing you need to look at is homeowners associations. Some homeowners associations don’t allow renters into an area. It’s pretty rare but it is possible that the homeowners association won’t allow it. So look at that issue and that might be what they’re thinking.

Joe: So all you have to do most of the time in these situations is help them understand what the reality is rather than what they think the reality is.

Joe: You also said here that the mortgage contract forbids rent to own, and that is very rare – to see that in a loan document – that they would allow any type of rental property. There is something called a due on sale clause – 99.9% of mortgages that I’ve seen have a due on sale clause. That due on sale clause says that if you transfer ownership of that property, that the loan can be called due and payable immediately. If they did that, that would mean that every subject to deal that I’ve ever done or that the thousands of other deals that I’ve seen done would have been called by the bank.

Joe: But banks don’t do that. Banks aren’t in the business of foreclosing a property – they’re in the business of loaning money and getting money back. And if you go in there and take a property and you continue to make your payments, they’re usually going to be fine with that. So I wouldn’t worry so much about this happening. They may just be misunderstanding what they think the lender is saying rather than what the lender actually is saying.

Joe: The lender is not saying you can’t rent your property even though you have a loan on that property. They would love it if you lived there, but they also know that that doesn’t always happen. They’re not going to foreclose on it for that reason. At least that’s been my experience. I’m not an attorney. I can’t give legal advice. I don’t even play one on TV. Alright, thanks.