Click Here For Buying Event Details

____________________________________________________________

My PushButton Automarketer Program – Automate your business:

http://www.pushbuttonautomarketer.com

My 6 month mentor program:

http://www.ZeroDownInvesting.com

http://www.JoeCrump.com/partner

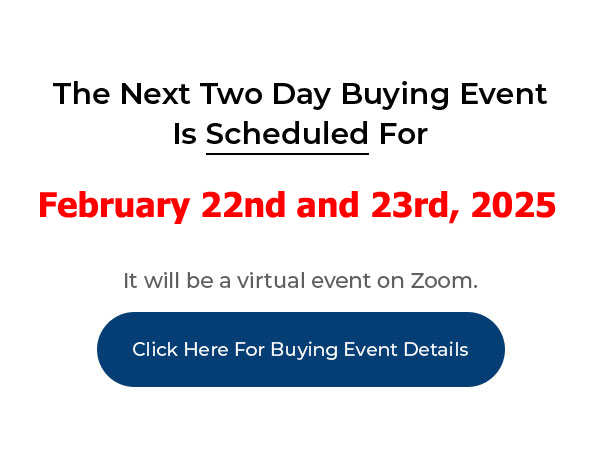

My Two Day Buying Events

My Real Estate Investing Blog:

My home study program (there are 68 free videos you can watch on this site):

http://www.PushButtonMethod.com

A Free Audio About How To Automate Your Real Estate Investing Business:

http://www.JoeCrump.com/pushbuttonmethod

My ebook:

http://RealEstateMoneyMaker.com

Free E-letter Opt-In Page:

A few Case Study Video Interviews with my Students:

http://www.JoeCrump.com/partner/casestudy.html

30 Day Free Trial Monthly Printed Newsletter and Audio:

http://www.RealEstateMoneyMaker.com/newsletter/main.html

And on youtube.com search “joseph4176”

Tips for Working with Other Real Estate Investors

Joe: Tips for working with other real estate investors. How to partner and not get screwed. What I suggest first of all is you set up an entity if you’re going to partner with somebody. Don’t work with, you know, as partners in your own name. Set up an LLC. Set up an LLC and then you can outline exactly how you’re going to work together. You’re going to have an Operating Agreement. You’re going to show exactly what the function of that LLC is going to be. Are you planning on buying properties and turning around and flipping them and making a profit? Are you planning on holding the properties long term? What is the goal of that LLC? Are you going to do multiple things? If so, what’s your exit strategy going to be?

Joe: How are you going to divide up the money? How much money is each partner going to put into the deal? Maybe you’ve got one person who does all the money and another person who does all the work. So let’s say you’ve got the money partner and he wants to make sure that he gets his money back before they do the split, before there’s a profit split. So you write it into the Operating Agreement. Let’s say you’re putting up $100,000 and you’re hoping to turn around and sell a property for $200,000 and maybe after all the expenses and everything you’re going to make fifty grand.

Joe: And then you’re going to split that $50,000 with your partner, the guy who’s actually doing the work. All you’re doing is coming up with the money. Or maybe vice versa. Maybe you’re doing all the work and your partner’s coming with all the money. But I know if I’m investing money I want to make sure I get my money back first before anybody gets any profits out of the deal. So once the expenses are paid, I get my money back and then what is left gets split up depending on whatever split that we’ve agreed upon in that transaction.

Joe: If you’re just doing a fifty/fifty and everybody’s bringing 50% of the money and both parties are bringing in 50% of the work, there’s always challenges with that. Because one person is going to do more work than another person. That’s just inherent with property, you know, with any type of partnership. And the problem is you, each party, may think that they’re doing more of the work. One person may be doing all the admin work and thinking, hey, I’m putting in all these hours, I’m putting in more hours than this guy over here. All he’s doing is putting together some deals.

Joe: And he’s making a few calls, he’s putting deals together and then I’m doing everything. I’m getting them cleaned up and I’m fixing them, selling them, and I’m putting all these hours in and doing all this work. We both have the same amount of money in the deal. You know, I feel like I’m doing way more than he is. But this guy over here, who’s putting the deals together, well that person is the rainmaker. That’s the person who’s actually doing the most valuable job. So that person probably should be the one who’s getting the most money.

Joe: You probably don’t want to have a partner who’s just an admin person. You want to have a partner who actually puts deals together because the deals are what make you money.

Joe: Now it might make sense to have a partner who’s just a money person so if you bring in a partner that’s just a money person that’s a possibility as well. The main thing though is to make sure that everything is laid out in writing, who gets what, when you’re going to sell your properties, how you’re going to sell them. Are you going to keep them long term? You know, make sure you have all that stuff outlined so that there’s no confusion about it. You know, you may get to a point where you may be thinking, look, I’m going to be retiring in five years and I want to make sure we sell all our properties in five years.

Joe: Where the other person may not be retiring for ten years and they don’t want to sell for ten years because they’ll lose money if they do that. So you have to make sure that you guys are on the same page before you start working together. And not just on the same page verbally, but on the same page in writing. Write it down. If it’s not in writing then there’s going to be dispute and that’s a great way to lose your friend.

Joe: I also suggest that you keep control of the bank account. And sometimes it makes sense to have both parties involved with the bank account. I would always want to be in control of a bank account in a partnership that I do. I want to be the only person in control of that bank account. Now I’m going to have my bookkeeper be the one who makes the payments to stuff and the partner may send in the invoices, they’ll get the payments and if I’m controlling the money I want to make sure that I’m the one that’s in control of the bank account. I probably would not invest in somebody else’s business by just giving them money.

Joe: Now, you might be able to find people that are willing to do that because they don’t want to have to think about it and they trust you and they think you’re doing a great job in your business and they might say here’s $100,000 – go invest in properties. That’s private money, that’s a different story altogether. But if you’re using your money make sure you have control of the bank account. And I would suggest even if it’s somebody else’s money that you keep control of your own bank account.

Joe: Hire a bookkeeper to keep track of everything. That way it’s not your fault if a mistake is made. Somebody else is there, everybody’s looking at that bookkeeper saying here’s what needs to be done. Now you’re going to want to pay attention, look at the bank accounts, you know, open them up once a week, once a month at least, and make sure that money’s going in and out like it should be. Make sure that invoices are coming in and being paid properly. Don’t be paying out stuff without invoices. Make sure you know what those invoices are for and that they’re being applied to the right job, the right property.

Joe: All that stuff is important and having a good bookkeeper do that can be a lifeline. Now a bookkeeper, a good bookkeeper, can be expensive but they’re absolutely worth it so that you don’t have to do that work and you can focus on the things that make you money. And the thing that makes you money as a real estate investor is buying properties properly. If you buy properties properly everything else can be done by someone else. So focus on those things. Finding good deals. Because that’s where the money’s at.

Joe: My advice for finding a partner is look for somebody who’s a rainmaker. A rainmaker is someone who’s putting together deals. Someone who can find sellers to find deals. That’s the main function you need. You may be thinking well, I’m pretty good on the phone and I can put deals together. You know, maybe what I need is somebody who knows computer technology. You know, getting into Joe’s Automarketer, sometimes it gets a little confusing if you don’t feel like you’re computer literate. And so you end up giving half of your business to somebody who knows how to do computer work.

Joe: Or you could find somebody for $15 an hour to do that work for you. So I would strongly suggest rather than bringing in a partner for that kind of work that you hire somebody to do that kind of work for you. And it probably makes sense for you to learn something as basic as the Automarketer, to learn that work yourself so you have a pretty good understanding of how that works. It’ll make your job a lot easier. It’ll also make your job as a rainmaker a lot easier. That way you’ll be focused on putting deals together and being able to use automation to do most of the work for you. And then bring in outsourced work for the stuff that you can’t automate.

Joe: So that’s a good start. If you’re going to be partnering with somebody else, make sure you have all your bases covered. Make sure you know who does what, make sure everything you have is in writing. Make sure you have control of the money and the money is properly accounted for. Make sure that the person that you’re partnering with is a rainmaker, someone who puts deals together, who actually is a profit center, you know, a source of income rather than an expense.

Joe: You can have everything else outsourced to other people. You don’t need a partner to do your admin work. All right. I hope that helps.

Joe: If you like this channel hit the subscribe button, hit the like button and if you’d like to find out more about my six-month mentor program go to ZeroDownInvesting.com and if you’d like to find out about my automation systems, a system that does all the work for you, go to PushButtonAutomarketer.com

Joe: All right. Good luck to you.